Which States are Eligible for Amazon’s Affiliate Program?

Amazon’s affiliate program is widely considered one of the best for novice affiliate marketers, and well-seasoned veterans often call it one of the best overall. Some very famous marketers use it, and promote its use to all comers.

That said, it’s not perfect for everyone, for one simple reason. According to certain tax legislation, Amazon is unable to operate their affiliates program in certain states. This is on a state by state basis.

To get the quick answer out of the way, every state in the United States is eligible for the Amazon affiliate program, with the exception of Arkansas, Colorado, Missouri, Maine, Rhode Island, and Vermont. There may also be other geographic restrictions outside of the United States; I don’t know, and Amazon does not list it on their FAQ.

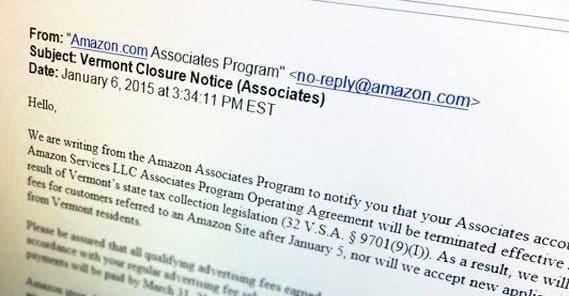

There are some relatively recent changes to this list. Arkansas was added to the banned list in 2011, and California was removed from the list around the same time, due to the repealing of the laws that caused them to shut down before. Vermont was added some time in early 2015, but is not currently on their FAQ. It is, however, in their Amazon Associates Program Operating Agreement. If you’re ever looking for up to date information, check that link, not their FAQ.

Why Certain States are Banned

The question on everyone’s mind is, why does Amazon disallow their program in certain states? It seems kind of arbitrary. The answer lies in state legal documents and taxes.

What happens is this. Some states are strapped for cash and are looking for ways they can tax residents in ways that don’t affect the majority and thus will be turned down. Raising a gas tax or a sales tax is almost always shot down, because most people are affected by it, so those people vote against it.

When someone floats the idea of a tax on “online income” or “affiliate sales income” however, most people aren’t affected by it. Only a few tens of thousands of people in each state tend to be affiliate marketers, fewer in smaller states. If a tax on those few raises money and is unlikely to be shot down, legislators pass it through.

These taxes do not inherently ban certain states from selling. Ordinarily it would simply mean the people who purchase through an affiliate in one of those states needs to pay sales tax. Basically, it works like this.

Normally, if you buy something online, you do not pay sales tax. This is because of the locations involved. A company like Amazon or Newegg is based in a certain state, and only residents of that state have to pay sales taxes. Otherwise, the other states are collecting taxes on good purchased out of state.

The legislature pushed through to tax these purchases on affiliate programs does so by declaring affiliate sellers to be a “sales nexus” for the company. Essentially, they’re saying that every affiliate seller is a micro-storefront for Amazon, or whatever other affiliate program is being run. This allows the state to say “look, people are making the purchase in our state, so we get to tax it.”

This becomes very complex when taxes overlap or when purchases are made with another entity or location involved. All together, it becomes a lot of bookkeeping and a lot of work, with no possible benefit; Amazon loses out on money due to the taxes, and more money due to the record-keeping requirements. It ends up being more profitable and less work simply to retaliate against the states in question and block them from using the affiliate program altogether.

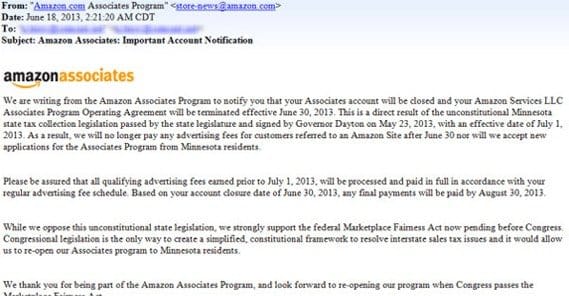

What this does, from Amazon’s perspective, is put pressure on the states to repeal the law. With Amazon affiliates no longer in the state, the tax does very little. Other affiliate programs can still run, but the income from Amazon is so much greater than most other affiliate programs that it hurts to be cut off. Plus, residents of the state who are affected by the issue will campaign to have the tax repealed, and are occasionally successful. California’s reinstatement is a big example of that.

The problem as many see it is that the so-called nexus laws treat affiliate marketers as if they are contractors or employees of the companies involved. This is factually incorrect, for very specific reasons, and yet the tax loophole is used to abuse that notion.

One thing to note is that this is all a simplified version of the situation. I’m not a tax lawyer, nor am I up to date reading the tax code for the states involved. You can read a more detailed version of events with any of my factual accuracies corrected here.

Fighting Tax Bans

There are a lot of people affected by these taxes, and a lot of people who have businesses that rely on affiliate sales to make ends meet. When a state passes one of these laws, it is highly discriminatory against these people, and it tends to close down these businesses. Where the state thinks its trying to make money with the tax, the reality is very different. They are putting people out of jobs, killing the income of citizens, and occasionally even driving people to homelessness. Yet some states persist on maintaining the tax, so marketers in these states need to figure out something.

There are some options for making money in these states, but they aren’t always good options. I’ll list them off, and you can decide what you want to do.

Option 1: Close Up Shop

This is the option a lot of affiliates take, particularly when they were relying too heavily on Amazon at the start, and were barely making ends meet. Closing up shop prevents the state from getting anything out of their tax law and helps put pressure on them to repeal it, but it doesn’t do you any good in the mean time. After all, it’s your business, and closing it up means you aren’t making any money. You have to find something else to do, be it move to another state, find a workaround, or find another way to monetize.

I don’t recommend closing up shop unless you’re desperate and have no way to progress. If you go from a profit to $0 overnight, it’s a desperate situation, but you might be able to fish something out. Remember; a functional site with search traffic is valuable, even if it’s not necessarily valuable to Amazon. You can find other ways to monetize – which I’ll cover later – or you can do something more organic.

One option is to turn the site into a more personal portfolio or an example of your skills a as a site designer. You don’t need to be actively selling products on Amazon to make money from them, after all. Sell your skills at setting up a function Amazon affiliate site to people out of state. You can transition from affiliate marketer to contractor.

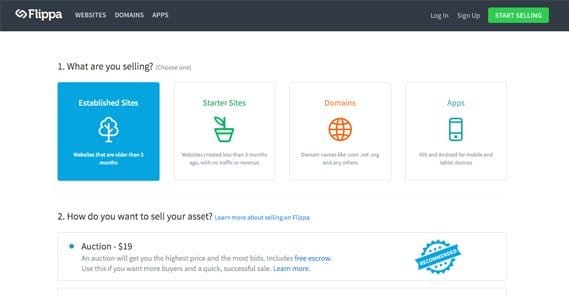

Another option is to build the site and then sell it. You won’t have active profit records for the most recent month, simply because of the change that closed you down, but you will still have traffic and past value to disclose. You can make a decent amount from a site that you keep updated and running, even if you’re not making much money from recurring affiliate sales. Whoever buys it can deal with swapping over the links to their affiliate code.

These options only really help for people who are in a state that passes such a law and shuts them down. You can’t really build up an affiliate site without being eligible for affiliates, after all. Most of the options on this list are for people who are scrambling to find a solution when Amazon shuts down in their area, but they can be valid paths for people who live in states like Colorado that have banned the program for much longer.

Option 2: Use Non-Closed Affiliates and Pay the Tax

There are hundreds of affiliate programs that shut down in response to one of these nexus tax laws. Amazon is simply the largest and most visible of them all. Unfortunately, it’s difficult to tell what affiliate offers are available and what are not. You will have to do some research to determine for yourself.

One resource you’ll want to keep on hand is something like OfferVault. OfferVault is an affiliate network aggregator. They pull together affiliate offers from a wide range of other sites and individual affiliate programs.

What you can do is strive to replace all of the Amazon links on your site with links to these sites. Often you will have to remove direct references in text to Amazon as well, so there’s no disjointed difference from old to new link.

Unfortunately, replacing your links en masse like this isn’t likely to have a good effect. For one thing, you might not be able to find offers for everything you were selling before. For another, Amazon’s ability to sell anything on the site and get a commission, regardless of whether you linked to that product directly, is a source of a ton of income for affiliates. That doesn’t happen with any other affiliate program, not really.

Another issue is just that prices will be lower. Amazon may not pay the best, but anyone selling what Amazon does probably pays worse as well. You’ll have to struggle to find valid, high quality offers.

On top of all of that, you lose out on the selling power and name recognition Amazon carries. When you’re an Amazon marketer, people know and trust Amazon, so they don’t need to worry about that aspect of the transaction. For other affiliate programs, though, the buyer might not know the seller by name or they might not trust the website. This hurts your click-through rate, it hurts your conversion rate, and it hurts your profits.

Option 3: Register an Out of State LLC

One workaround that some people have implemented is registering themselves a business out of state. The most common state is Nevada, followed by Delaware. Delaware has very flexible business laws and their legal process is very lenient toward businesses. There’s no state corporate income tax for businesses formed there that do not do business there, as well; specifically the solution to the nexus tax problem.

Nevada is much the same. They lack the state corporate income tax and franchise tax, and some other state benefits. You can read about the benefits here.

In both cases, the idea is simple. Your state is using a tax loophole to consider you an extension of Amazon, and thus tax you as a business representing Amazon in your state. By incorporating your business as an LLC out of state, you can point to that in return. You’re not doing business in your state, you’re doing it out of state, see? You just happen to run your business from your state.

This is not a flawless plan, however. You have to do some complex legal workarounds to get it to work. You don’t make money directly from affiliate sales any more; your company does. Your company pays you as the sole shareholder, but you will have to pay some towards your business in other ways, including various fees and taxes.

Another flaw is that you have to pay to incorporate an LLC, and the fee is often substantial, particularly compared to low-end affiliate marketing profits. It might not be worth it to manage.

On top of all of that, if you do pull it off, you will have to deal with a lot of complexity come tax time. You have your own income and your business to worry about, and it will very likely be beyond the ability of a layman to work out the intricacies. You will have to hire a professional tax preparer, which will cost even more money.

Not to mention, all of this puts you at a much higher risk of an IRS audit, so you need to be a stickler for keeping everything in order, and keeping records of it all, lest you end up getting things wrong.

Overall, this is a way to keep using Amazon, but it’s a very expensive way to do it. I only recommend it if you have a long-established business with a lot of income and savings, and you can afford these various requirements.

Option 4: Monetize Through a Third Party

Now and then, you can find a workaround option that works. Back in the day, the solution was VigLink. At the time, what they did was operate Amazon affiliates using their own account, based in a state that allowed Amazon affiliate sales without the additional nexus tax. Any sale you referred through them, through Amazon, was then paid to you, minus their minimal cut. They did a lot of business – and had a lot of tools to help you succeed as an affiliate marketer – so the minor cut didn’t matter all that much.

The problem is that VigLink, and other companies like them, have been shut down by Amazon. VigLink still exists, but their workaround for Amazon blocked states no longer works. That’s why I say you can find such a workaround “now and then.” When one pops up, it tends to only work for a few months before it’s shut down by Amazon.

Amazon doesn’t like these workarounds because it circumvents their ban of the states in question, which eases the pressure and incentive you have to protest the law and try to change it. No progress is made if there’s no pressure.

Option 5: Monetize Through Other Methods

This is by far the best option, though it will require some reorganization on your part. You can make a shift in your business, away from affiliate links and into another form of monetization.

There are a lot of different ways you can monetize your site. Normal PPC ads are probably the next best thing compared to affiliate links, and you can use them in conjunction with existing affiliate offers that aren’t blocked in your state.

If that’s too low-effort and low-reward for you, you can go with a product of your own. You can sell ebooks, consulting, design services, and a whole host of other products. You can even take the time and savings from your business to make something you’ve always wanted to make, an actual product rather than a digital product.

How you adapt is up to you; just make sure you do something with your business and avoid letting it fall into disrepair, in case Amazon relents and lets your state back into the fold.

ContentPowered.com

ContentPowered.com

The states really should get away from sales tax and go with the same type of thing Hawaii uses which is a General Excise Tax (GET). With GET a business is paying a tax on their business income regardless of where the customer was located. The rate of tax varies depending on the businesses location in the state as there are state and local levels of the tax just like with sales tax. Merchants are allowed to recoup the tax by adding it to their sales which many do, but this is not required and there are no reporting requirements for what was collected (or not). There is only one GET return to be filed with the state and they handle the distributions of tax revenues to all local authorities. This greatly simplifies book keeping for businesses. It avoids all the pitfalls that the sales tax schemes are running into due to online sales and purchases, and it allows affiliates to operate like every other business. After having lived in Hawaii for 6 years and then having to deal with standard sales tax again on the mainland it became REALLY apparent the GET was a great thing for everyone.

You should add Louisiana to the list that cannot participate in the affiliate program.