List of Ad Networks That Accept Cryptocurrency Payments

Cryptocurrencies have been taking the world by storm. They’re an interesting technology that has evolved into a new class of commodities powered by, well, more or less the whims of the people. While there’s an argument to be made that there’s no actual value in something like Bitcoin, there are also people who have made off with millions through cryptocurrency trading, so I try not to be too harsh in my criticisms.

If you’re one of the people who has adopted Bitcoin, or has invested in one of the over 1,300 alt-coins, you’re probably looking at ways to make use of it in payments. After all, they are meant to be currencies.

Using Cryptocurrencies for Payments

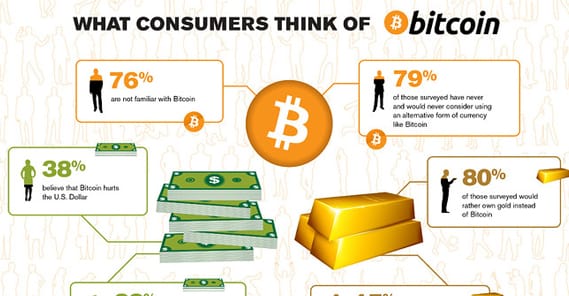

One quirk of the way cryptocurrencies work is that they don’t actually hold much trust among your average consumer. I mean, if you offer an hour of your services for $100 and someone pays you with a $100 bill, that $100 bill is worth $100 now, a week from now, a month from now, and a year from now. The price of the goods and services you buy with it might rise a little, but $100 is $100.

With a currency like Bitcoin, if someone pays you $100 worth of BTC, that isn’t $100. If Bitcoin goes up tomorrow, that $100 might be worth $120. If Bitcoin goes down, suddenly you were only paid $80 for your services. Bitcoin is an insanely volatile commodity, and very few businesses want to have any significant amount of it on hand at any given time. It’s a recipe for disaster; one crash can cause a significant loss in value. A bank account doesn’t do that. Most of the smaller cryptocurrencies are similarly volatile, though their swings are smaller simply due to the monetary scale they’re operating on, since nothing has taken off quite the same way as Bitcoin.

The quirk this has caused is that to use a cryptocurrency as payment for goods and services, you have to go through an appropriate payment processor. Often times, if a website says they accept Bitcoin as a payment method, what they’re doing is sending you to a processor of their choice. You agree to pay $100 in Bitcoin and send it to the processor. The process then sends $100 USD to the company; they never actually have their hands on BTC themselves.

For a lot of the smaller altcoins, you have to actually go one step further. Even if a website accepts BTC as a payment option, that doesn’t mean they’ll accept Ripple, NEO, Dogecoin, Verge, Decred, Ubiq, or whatever else sprang up this week.

In these cases, you have to convert your altcoin into one of the majorly accepted cryptocurrencies through one processor, then use THAT currency through the vendor’s processor to actually buy your goods. This means you have extra transaction fees, extra time for the transaction to process, and more chance for currency fluctuations to hurt your currency value.

I bring all this up for one reason. Technically, you can at any time convert your cryptocurrency into USD through whichever processor you desire, then take that money to any ad network you could possibly want to use. Any ad network will “accept” crytpocurrency if you first convert it into real money first.

All of that said, the ad networks I’ve listed out below are all ad networks that work with an exchange to “directly” accept cryptocurrencies. Generally they’ll accept Bitcoin and a couple of the larger altcoins like Etherium and Litecoin, and not much else. I’ll try to point that out when I can. Anyway, here’s the list.

CoinAd, BitsForClicks, ETC

I put this one up at the top for one major reason: beware any cryptocurrency-focused ad network. Many of them are straight-up scams with some of the oldest tricks in the book.

If you check out reviews for CoinAd, you see a lot of people who don’t get paid and a lot of people who lose their coins. The problem is that, while CoinAd (and other sites like them) boast huge amounts of ad impressions and targeted advertising, they don’t actually have sites in their network.

The flip side of sites like CoinAd is an “earn Bitcoins” scam. People register to “earn” coins from CoinAd on an invite-only basis. There’s red flag number one; they claim to have delivered over 1.1 billion ad impressions in the last 30 days, but they’re invite-only, so publishers can’t simply sign up. How huge a network do they think they have on an invite basis?

The people who sign up don’t run banner ads on their websites, they’re simply directed to a portal where they are shown “ads” that advertisers are paying BTC to run. They’re then paid to click those ads, with a promised payout of a few cents of BTC per click. These kinds of “ad networks” have been around for a long time, and they’re generally worthless to everyone involved except the network itself, which is raking in the cryptocash.

I would generally recommend that you be very, very careful if you’re thinking of using a Bitcoin-first ad network. Bitcoin hasn’t been around long enough as an accepted payment method for these kinds of businesses to shake out. Many of them have little in the way of verification that they’re legitimate, and many are simply operating on a shoestring basis before they can cut and run.

What you want to find are legitimate ad networks that have cryptocurrency as one of several payment options. Anything that is branded centering around cryptocurrencies simply doesn’t have enough trust for me to recommend just yet. Maybe in a few years, a few legitimate leaders will have shaken out, but for now, err on the side of caution. Even something more legitimate like Coin-Ad has abysmal statistics. Do you really want to invest in an ad network that is averaging under 600 clicks per day across the entire network?

The one exception to this is if you’re trying to advertise a site that is heavily cryptocurrency-focused itself. Something like BitMedia can be a decent choice, since they’re all-in on the crypto bandwagon, focusing entirely on that niche.

Even so, their statistics don’t look impressive; they showcase some 16,000 clicks across their network on a 24-hour basis, but the size of their network indicates that’s something like 5 clicks per website per day. Not very impressive for an advertising network.

Other potential Bitcoin-focused ad networks that aren’t easily identifiable scams include:

- Mellow Ads – A small network focused on simplicity over complexity or control.

- Anonymous Ads – A small network focusing on anonymity; you don’t need to give them any personal information to advertise with them.

- RunCPA – A small network that focuses on affiliate marketing rather than CPC marketing. Noteworthy in that they’re anonymous like A-Ads and that they use Bitcoin internally, so they’re subject to fluctuations themselves.

- Coinzilla – A relatively traditional small network that focuses on pop-unders, those old scourges of marketing, and works with adult sites.

- Crypto Media Hub – A somewhat larger network that nevertheless focuses exclusively on cryptocurrency-focused sites, with a site that provides virtually no information to use to decide if you want to join.

- CoinURL (now dead) – A URL shortener similar to AdFly that shows interstitial ads to people who click the link. This had mixed reviews, so you probably weren’t missing anything here.

As you can see, a lot of the Bitcoin-focused ad networks are small and focus more on a gimmick than on having a large network. They may be useful for some small supplemental traffic, but let’s be honest here; anyone deep enough into Bitcoin to be browsing a BTC-related site is going to be using an ad blocker. These networks have pretty slim effects.

BuySellAds

BSA is one of the larger more traditional ad networks. They have five possible ad formats; native advertising, sponsored content, podcast advertising, traditional display advertising, and email advertising. They also maintain a large marketplace where you can make deals directly with specific websites ranging from CoinDesk to SitePoint.

BuySellAds supports Bitcoin, but you have to pay into an account with BSA. It’s sort of like a prepaid card, or adding credit to your account. You go through CoinBase to convert your cryptocurrency into USD and send that USD to BSA. You then use your credit on the site to pay for the ads you want to purchase. If you don’t have enough credit, you have to add more or add another payment option. It’s an additional hoop to jump through, but it works.

BuySellAds was actually one of the first major ad networks to accept cryptocurrencies, and as such have had a few features on Bitcoin.com and recommendations throughout the industry. If you’re interested in BTC payments or payments using another cryptocurrency, you can certainly find worse options. At least BSA has a long history, a good reputation, and a publisher network that can get you orders of magniture more traffic than any of the small BTC-focused networks above.

Adverti.io

A hybrid platform that took an existing ad network and added the ability to pay partially or fully with Bitcoin or, through Shapeshift, a handful of altcoins. They pay publishers in CPM and revenue share models, so they’re strictly a CPM network. They mostly do traditional display advertising, but have options for pre- and post-roll video ads, mobile and app ads, and text ads. They’re also pretty simple; they only do geographic and site-specific targeting. Publishers are required to have 50K views per month minimum.

I frankly haven’t heard much good or bad about this site. They seem functional, and they accept BTC as a payment option, which is all I really need for this particular review. As always, if you’re going to try out an ad network, start small. Don’t dump a huge budget in until you’re sure you see returns.

And… that’s about it. Other than these two networks, I’m having a hard time finding any ad networks that a) existed before Bitcoin hit the market, b) are not heavily Bitcoin-branded and themed, and c) still exist. If you ever wanted to know what the biggest issue with BTC-focused ad networks was, just look at any top list of cryptocurrency-focused ad networks from the past two years and see how many of them are now dead links. Heck, I wouldn’t be surprised to find many of the links I posted above will be dead by the end of 2018.

The Modern Issue with Bitcoin Payments

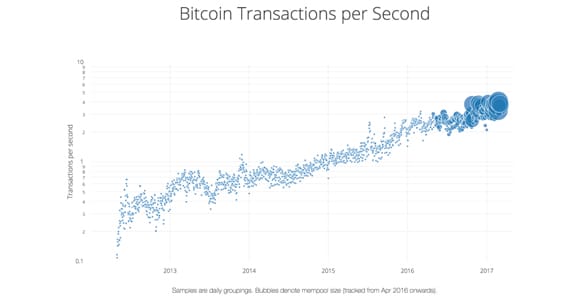

To close out this post, I want to bring up one issue that a lot of Bitcoin-focused ad networks are encountering. Bitcoin requires a verification with the blockchain to confirm any transaction moving BTC from one wallet to another. With a typical bank, these sorts of confirmations are processed by the millions every hour and are virtually instant. With Bitcoin, because of the way the blockchain works, confirmation times tend to drag out. In fact, confirmation times have been spiking since the start of the new year, where it could literally take hours or even days for a transaction to complete, by which time the value of the currency may have changed significantly.

In fact, since January 1, transaction times have ranged from 27 minutes to 383 minutes on average, which is a significant amount of time when you’re hoping to run agile advertising. Adapting to the whims of traffic is important, so if you’re paying with BTC, you’re going to need to load up an account with BSA or something beforehand so you can pay as needed on an ongoing basis.

There are some attempts to address the variability and length of transaction speeds, but thus far no single solution has emerged. For now, you’re simply at the mercy of the trends of the market; when value changes dramatically, transactions spike, so the speed of those transactions drops.

ContentPowered.com

ContentPowered.com